Updated: Jan 21st, 2025

Auction House London’s Guide on Buying and Selling Probate Properties at Auction

Buying or selling probate properties at auction in the UK is an efficient way to handle an estate or acquire a property at a competitive price. Such properties are part of the estate left behind by someone who has passed away and can often present unique opportunities for investors, although both buyers and sellers must navigate specific legal processes first.

Here Auction House London presents a guide that outlines the key steps and considerations when buying or selling probate properties at auction, including the potential risks and rewards.

What is a Probate Property?

First off, a quick explanation of what exactly a probate property is their unique status. As mentioned above, a probate property forms part of the estate of someone who has died and there is a legal process to obtain ‘probate’ that must be undertaken before the property can be sold. Obtaining probate grants the executor or administrator with the authority to manage and distribute the deceased’s assets, including the property.

Only after probate is granted can the property be sold, often through auction due to the speed and transparency that auctions provide.

Buying a Probate Property at Auction

Buying a probate property at auction presents an opportunity to secure a property at a potentially lower price, but it still requires careful preparation. After you register with the auction house as a bidder, you should inspect the property you are interested in before the auction begins. Probate properties are often unoccupied for an extended period, which can lead to issues such as damp or disrepair. If possible, commission a survey to assess the property’s condition, as auction sales are typically final.

Also make sure to review the legal pack as it will contain vital information such as title deeds and any special conditions. Seeking legal advice at this stage is essential to avoid unexpected issues like boundary disputes or restrictive covenants, which could affect the property’s value or future use.

Financing is another critical aspect you should consider before taking part in an auction, online or otherwise. This is because auction purchases typically require a significant deposit immediately after a successful bid, with the remainder due within a specified period such as 28 days. Ensuring you have the necessary funding in place – whether through cash or a mortgage – is absolutely essential. Also keep in mind that some mortgage providers may be hesitant to lend on properties in poor condition, so having a pre-approved mortgage is certainly advisable.

Finally, set a budget and be sure to keep to it during the auction itself. Sometimes you may have an easy run at a property, but there could also be a bidding war which ends up more expensive than you were originally willing to pay. While the transparency of the auction process ensures a swift transaction, it also leaves no room for negotiation after the successful bid is accepted.

Selling a Probate Property at Auction

Before listing a probate property for auction, it is crucial that probate has been granted. Once it is, opt for an auction house with experience in probate properties, as they will be familiar with the process and will be able to advise you on setting a suitable reserve price.

Once the auction is complete, the sale process moves quickly as the buyer is legally obligated to complete the purchase within the specified time frame. This certainty is one of the primary reasons probate property executors favour auctions, as it eliminates the risk of buyers pulling out of the deal, which can be a common issue in traditional property sales.

Benefits and Risks of Probate Property Auctions

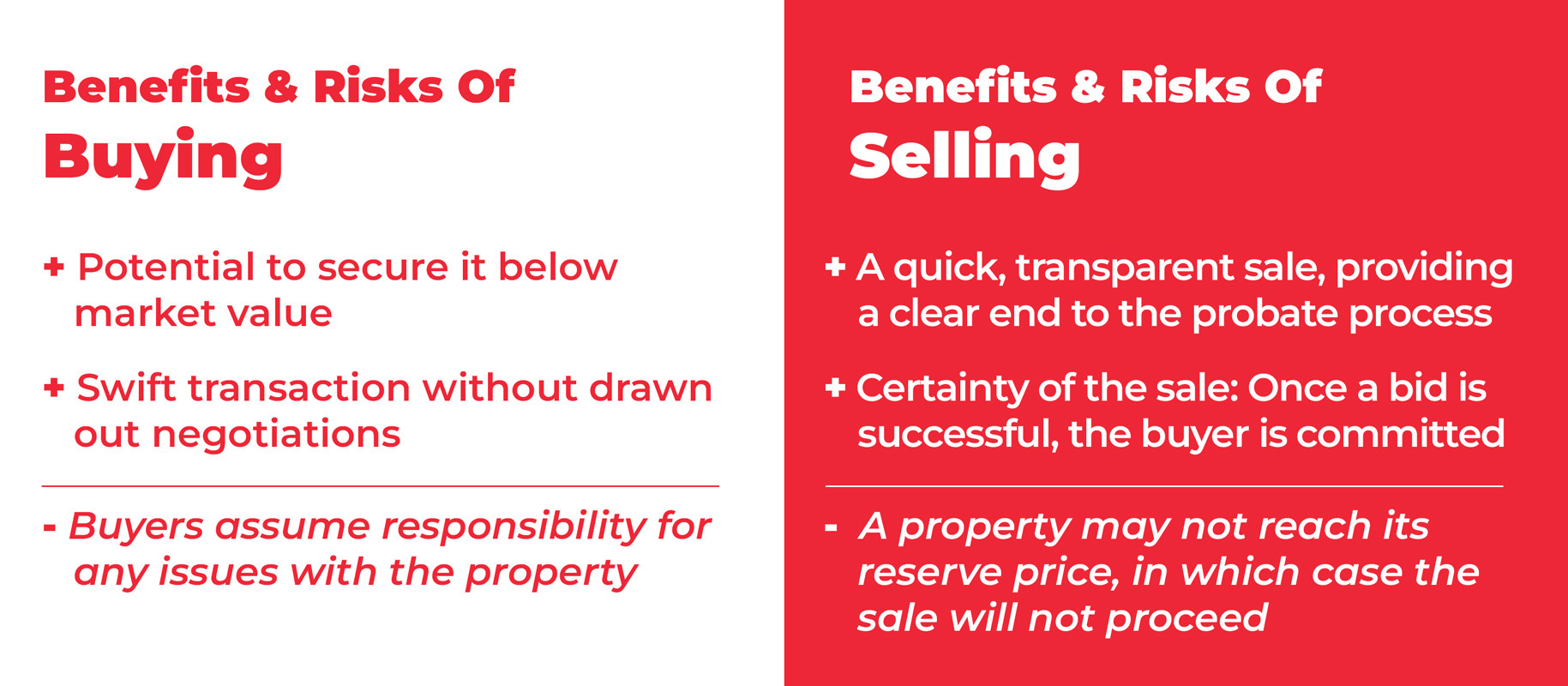

For buyers, the primary benefit of purchasing a probate property at auction is the potential to secure it below market value. The speed of the auction process is also attractive, offering a swift transaction without drawn out negotiations. However, there are also risks. For example, properties are sold ‘as seen’ and buyers assume responsibility for any issues with the property, such as structural problems or legal complications. Failure to inspect the property thoroughly or review the legal pack can lead to costly surprises.

For sellers, auctions offer a quick, transparent sale, providing a clear end to the probate process. The certainty of the sale is a major advantage, as once a bid is successful, the buyer is committed. However, there is a risk that the property may not reach its reserve price, in which case the sale will not proceed and the property will be listed among the unsold lots on the auction house’s website. This could delay the administration of the estate and prolong the probate process.

Andrew Binstock

Andrew is widely considered to be one of the best auctioneers in the UK with his energetic and passionate style combined with his ability to entertain the audience and his refusal to bring the gavel down until the very last pound has been extracted.