Updated: Mar 26th, 2025

Ground Rents: Unlocking Value in Your Property Portfolio

Introduction

Property investment can be lucrative and savvy investors always look for opportunities to

enhance their portfolios. One such opportunity that often goes unnoticed is ground rents.

This blog will explore ground rents, how they can add value to your property portfolio and

why property auctions are an excellent acquisition platform. So, let’s dive in!

Understanding Ground Rents

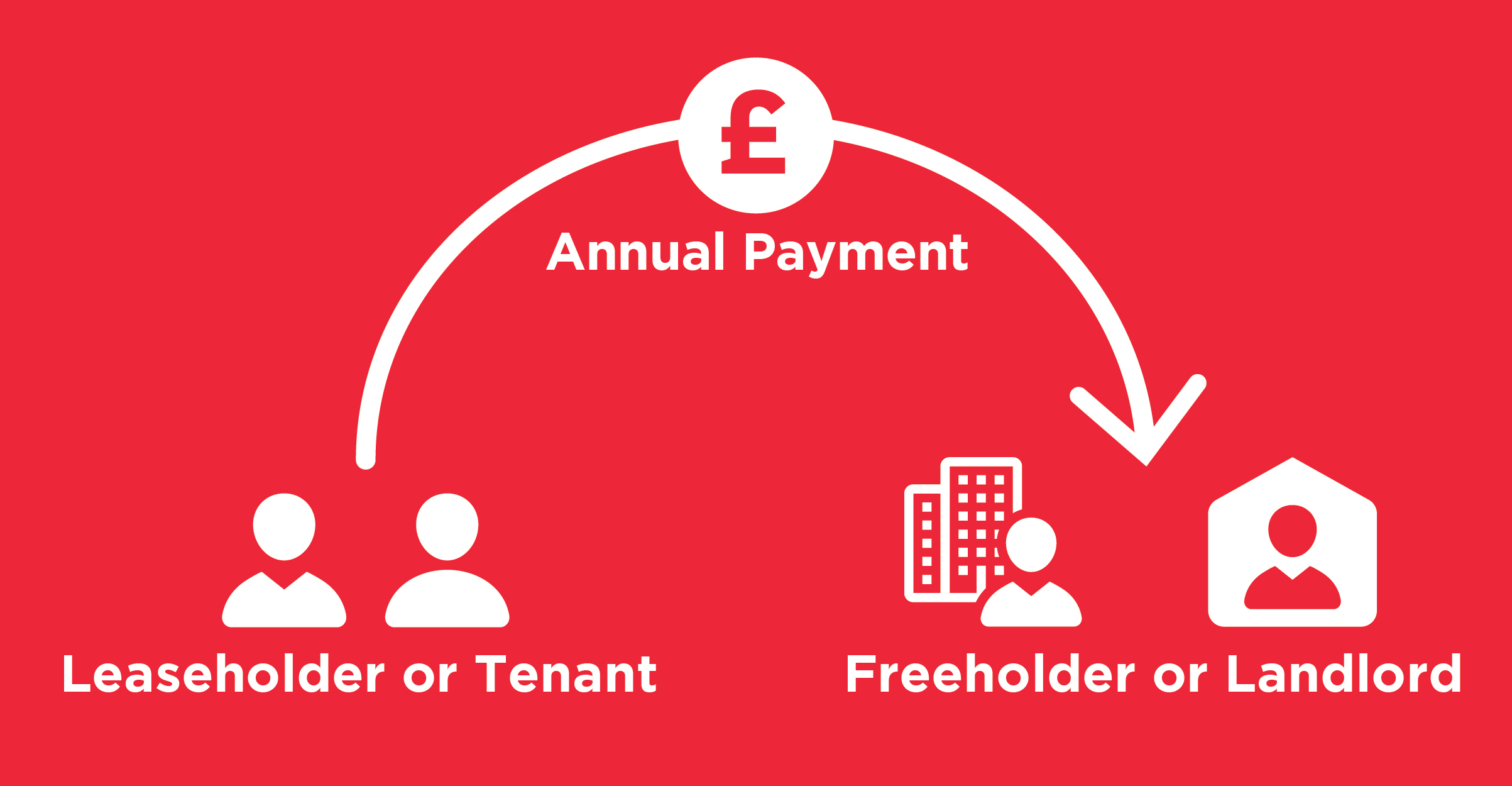

Ground rents are a long-standing feature of property ownership in the United Kingdom. They

represent an annual payment made by the leaseholder (or tenant) to the freeholder (or

landlord) for the right to occupy the property. While traditionally associated with leasehold

properties, ground rents can be found in freehold arrangements with shared amenities or

services.

Adding Value to Your Property Portfolio

2. Steady Income Stream

Ground rents provide a reliable and consistent income stream. As an investor, you can enjoy

regular payments from leaseholders, ensuring a stable cash flow for your property portfolio.

2. Long-Term Investment

Ground rents offer a long-term investment opportunity. Leaseholders typically have lease

terms ranging from 99 to 999 years, ensuring a reliable income stream over an extended

period. This longevity makes ground rents an attractive proposition for those seeking stable

returns.

3. Potential for Growth

Ground rents can appreciate over time. They can be sold or assigned, allowing you to realise

capital gains. Additionally, periodic rent reviews can be included in lease agreements,

providing opportunities to increase the income generated by the ground rents.

4. Minimal Management Responsibilities

Unlike other property investments, ground rents require minimal management

responsibilities. Leaseholders are responsible for property maintenance and repairs, freeing

you from the burdens associated with property management.

Why Buy Ground Rents at Property Auctions?

Property auctions offer a unique platform to acquire ground rents, providing several

advantages over traditional property purchasing methods.

1. Broad Selection

Property auctions feature a diverse range of ground rents, catering to various investment

preferences. With a wide selection, you can find ground rents that align with your investment

goals and criteria.

2. Competitive Pricing

Property auctions foster a competitive bidding environment, which can result in favourable

pricing for buyers. The absence of lengthy negotiations and the transparent nature of the

auction process ensure that a fair market value is established.

3. Immediate Acquisition

Property auctions allow for swift acquisitions. Upon winning a bid, you can complete the

purchase promptly, enabling you to start enjoying the income generated by the ground rents

without unnecessary delays.

4. Potential for Bargains

Auctions can present opportunities to secure ground rents at favourable prices. Motivated

sellers or unique circumstances may result in undervalued properties, allowing astute

investors to acquire ground rents at a discount.

Conclusion

Ground rents offer an excellent opportunity to add value to your property portfolio. Their

steady income stream, long-term investment potential and minimal management

responsibilities make them attractive to investors. Property auctions further enhance this

opportunity by providing a diverse selection of ground rents and a competitive bidding

environment. So, next time you consider expanding your property portfolio, don’t overlook the

potential of ground rents at property auctions. Embrace this often untapped avenue and

unlock the value it can bring to your investment journey.

(Note: The information provided in this blog is intended for general informational purposes

only and does not constitute financial or investment advice. Always conduct thorough

research and seek professional guidance before making investment decisions.)