Updated: Mar 26th, 2025

Exposing the Top 5 Property Auction Myths

Exposing the Top 5 Auction Myths

In what was once seen as a niche market predominantly for investors and developers, property auctions have witnessed a surge in popularity in recent years. The way people choose to buy and sell property has undergone significant changes with the last few years in part driven by the pandemic, property auctions are now being used as a means of sale by all types of buyers, from portfolio landlords to first-time buyers and sellers.

Despite the growing appeal, driven, in part, by the unique benefits of buying and selling at auction, such as the speed of the completion process. There are still certain myths and stereotypes that persist around property auction market.

As leading residential and commercial property auctioneers, Auction House London is no stranger to some of the myths related to property auctions. Here, we uncover some of the biggest misconceptions when buying and selling property at auction.

Myth one – Only cash buyers can purchase property at auction

Property can be bought at auction utilising a variety of products including from specialist auction financing companies. Properties can also be purchased with a mortgage or cash. Buyers need to put a deposit down initially and must have funds with their lender arranged in order to act quickly and meet the completion timeframe, which is much shorter compared to traditional property transactions, often around 28 days.

For buyers who are looking to secure funding for a property listed in one of Auction House London’s auctions, we work with Together, experts in short-term finance. Their finance team are on-hand before, during and after the auction to help buyers secure the funds required within a tight timeframe.

Myth two – All properties at auction require updating or modernising

There are many reasons why vendors use an auction to sell their property, these motivations include a desire to sell quickly, the property maybe a probate property or it could be a investor wanting to add or divest their property portfolio. Therefore properties listed at auction present in all types of conditions, ranging from full modernisation projects to homes that can be occupied immediately or if you are an investor, some properties are already tenanted.

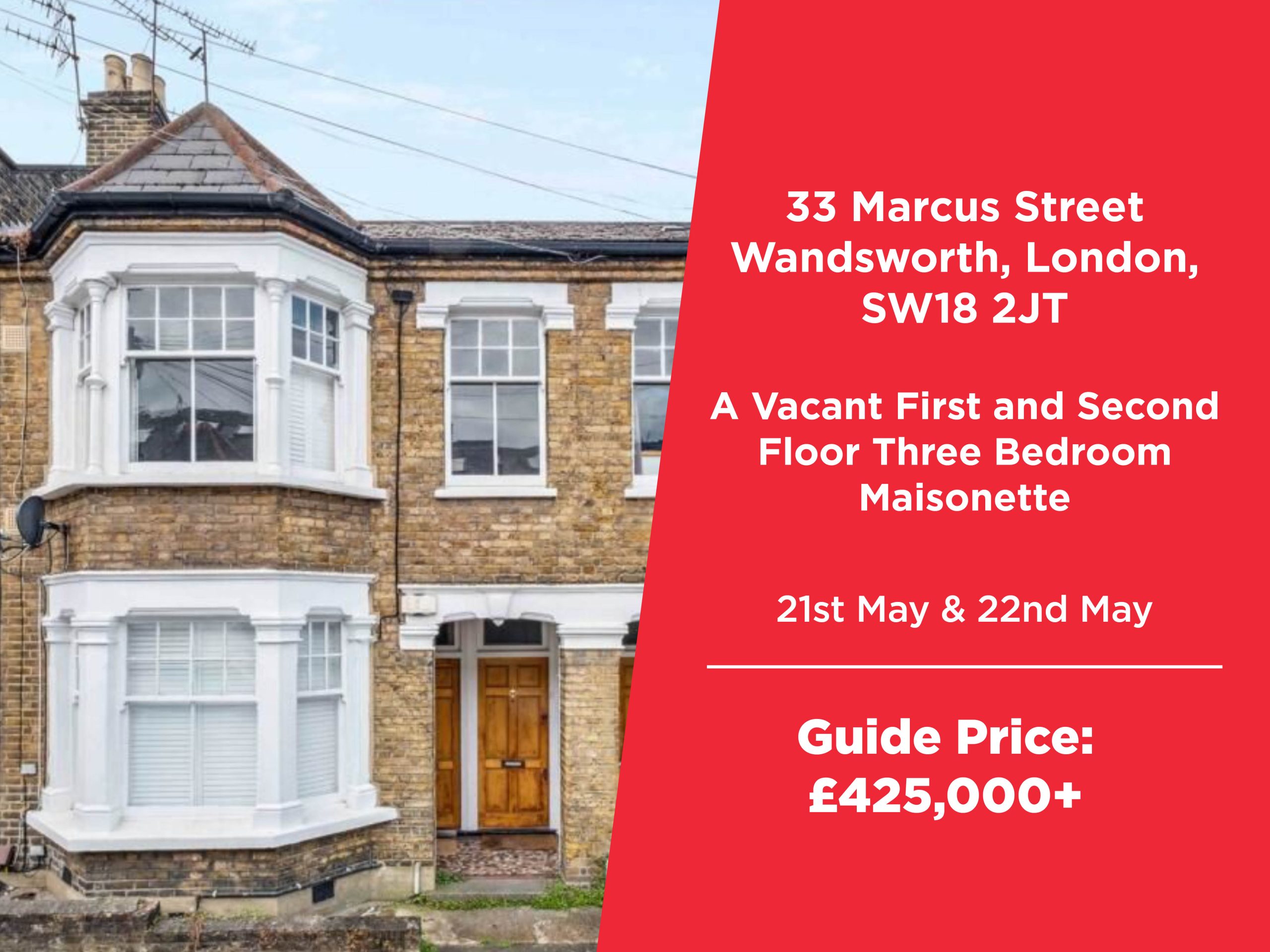

This vacant first and second floor three-bedroom maisonette in Wandsworth, London, which is listed in our next auction on May 21, is a fine example of a property that is in good condition.

Myth two – All properties at auction require updating or modernising

There are many reasons why vendors use an auction to sell their property, these motivations include a desire to sell quickly, the property maybe a probate property or it could be a investor wanting to add or divest their property portfolio. Therefore properties listed at auction present in all types of conditions, ranging from full modernisation projects to homes that can be occupied immediately or if you are an investor, some properties are already tenanted.

This vacant first and second floor three-bedroom maisonette in Wandsworth, London, which is listed in our next auction on May 21, is a fine example of a property that is in good condition.

Myth three – Only experienced investors should use property auctions

Another popular misconception when it comes to property auctions, is that they are only used by experienced property investors. On the contrary, anyone can buy and sell property at auction, regardless of their experience or status.

For those using a property auction for the first time to either buy or sell property, the process might be slightly daunting. Auction House London’s team of expert auctioneers are here to guide you through every step of the way. Additionally, we have put together a Guide to Buying at Auction. This comprehensive guide provides support to buying at auction. We look at the actions to take before the property auction, from identifying the properties that may be of interest from our extensive property auction catalogue, to arranging finance, if required. Our step-by-step guide to buying at auction includes information on how to bid once, as an interested buyer, you are registered. The guide also looks at what happens on the day of the property auction and, crucially, what happens if you are the successful bidder.

Similarly, we have put together a Guide to Selling at Auction, which takes sellers through the process of selling a property at auction. We explain the key concepts including the reserve price and anti-money laundering documentation, in this essential guide to selling property under the hammer.

Myth four – Auctions are risky

The perception that property auctions are risky is greatly exaggerated. The reasoning behind this myth is associated with the risk that bidders may end up overpaying for a property. However, buyers are encouraged to use due diligence prior to the auction, including viewing the property they are interested in, researching the cost of houses in the area the property is located and setting a budget based on what they believe the property is worth. If you have any questions or concerns about what a property listed with Auction House London is worth, don’t hesitate to get in touch with our team of property auction experts, who will be able to advise you the best they can.

Myth five – A property will sell too cheap

Listing a property at auction does not mean that the property will end up being sold below the market value. On the contrary, a seller sets a reserve price, ensuring that the property does not sell for less than they are willing to accept. Auction House London offers free valuations on all types of property and will be able to advise you on what reserve price you may want to set. Although it is important to have an attractive guide price to generate interest, the role of the auctioneer is to create a frenzy of competitive bidding that often results in higher selling prices being achieved than if the property had been sold through more traditional auction routes.

If you want to discuss any aspect of buying or selling property at auction, then don’t hesitate to get in contact with our friendly team of property auction professionals.